Fritz Sybergs Vej 9

DK 8270 Hojbjerg

Scandinavia

info@dynamicbusinessplan.com

Re-posting a Voucher

Maybe you find out that you earlier on have entered a wrong figure from one of the vouchers.

If you entered a figure that was too big you have to "re-post" the difference between what you have entered and what it should have been. The amount that was too much must be drawn out again.

If on the other hand you entered a figure that was too small you now have to make an additional entry of the difference between what you entered and what it should have been.

Example

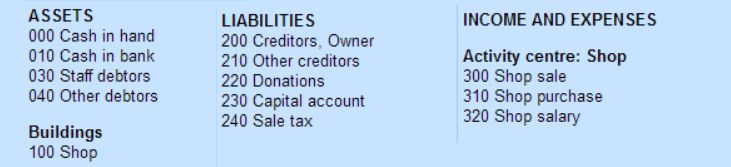

You have entered the shop sale at $ 970 but find out that it should only be $

950. Then you have to credit (take out) the difference of $ 20 in the

Cash/Bank-Account because here you debited the $ 970 which was 20 too much.

And you have to debit the $ 20 on "Shop Purchase-Account" because here

you credited the $ 970.

Explane the re-posting

In the text you say which voucher you are re-posting so that it is possible to

track the re-posting.

If you make an additional posting you also mention the original voucher number

in the text.

I have no use for bodyguards, but I have very specific use for two highly trained certified public accountants.

- Elvis Presley, American singer