Fritz Sybergs Vej 9

DK 8270 Hojbjerg

Scandinavia

info@dynamicbusinessplan.com

Double-entry Bookkeeping

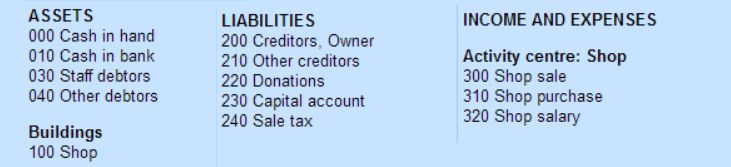

The Double-Entry System is a world wide used system to keep track of money.

The double-entry bookkeeping system is based on the principle of double registration in the bookkeeping programme of all income and expenses, - one debit and one credit entry.

- A debit for something coming in - money or other value

- A credit for something going out.

Every time you debit an amount you have to credit it too. And the other way round.

Things you buy

You can think of it like this: When you pay out money from the cash box it does not just disappear from you. The value of the thing you have bought is coming into your company.

So in the PC bookkeeping programme you register the amount of money that was "paid out" on the Cash/Bank-Account (credit).

And you register the value that was "put into" the company in return, on the relevant account from the account plan (debit)

- Example:

If you buy 12 computer games to your shop, you take money out of the cash box or the bank (which you credit the Cash/Bank-Account).

Then you enter value (12 computer games) into the shop (which you debit on the Shop Purchase-Account account in the PC bookkeeping programme).

Things you sell

And opposite, the money that comes into the company does not just come out

of the blue.

When money comes in, some value goes out of the company.

So when you in the Cash/Bank-Account register the amount of money that came in, you also register the value that was taken out of the project instead on the relevant account in the account plan.

- Example:

The sale for a full day in the PC Game Store is registered in the PC bookkeeping programme (which you debit the Cash/Bank-Account). Since you have taken the value of the computer games out of the shop you also credit the Shop Sale-Account .

Always both a debit and a credit

When you enter a debit on the Cash/Bank-Account you must enter a credit on

the relevant account from the account plan.

And opposite, when you enter a credit in the Cash/Bank-Account you must enter a

debit on the relevant account from the account plan.

- The debit in the Cash/Bank-Account balances with the credit on the

relevant account from the account plan

- The credit in the Cash/Bank-Account balances with the debit on the relevant account from the account plan

The PC helps you

If the registered accounts in the debit and credit sides do not balance

there is a mistake somewhere in the registration. The PC bookkeeping programme

will usually attract your attention to the mis-balance in the entries.

.

- Go to next business issue: Who is Able to do The Accounts

You have to understand accounting and you have to understand the nuances of accounting. It’s the language of business and it’s an imperfect language, but unless you are willing to put in the effort to learn accounting – how to read and interpret financial statements – you really shouldn’t select stocks yourself.

– Warren Buffett, American investor